Giving Options

Planning gifts and bequests allow you to make a strategic charitable donation that can provide a tax benefit and a lasting legacy!

Explore the available giving options by choosing your goal:

Stocks and Securities

- Reduce estate taxes

- Receive immediate tax benefit

- Reduce capital gains tax

Donating public securities is a tax-smart way to support Kerr Street Mission. The value of your charitable tax receipt is based on the market closing price on the day that the Kerr Street Mission Foundation receives your gift in its brokerage account.

Benefits of gifts of stocks and securities:

- Receive a charitable tax receipt for the fair market value of the donated security

- Benefit from a capital gain inclusion rate of zero when you directly donate eligible securities

- When your executor donates eligible securities, your estate does not pay the capital gains tax that is triggered on death under the Graduated Rate Estate Rules, and it also benefits from the full charitable tax receipt

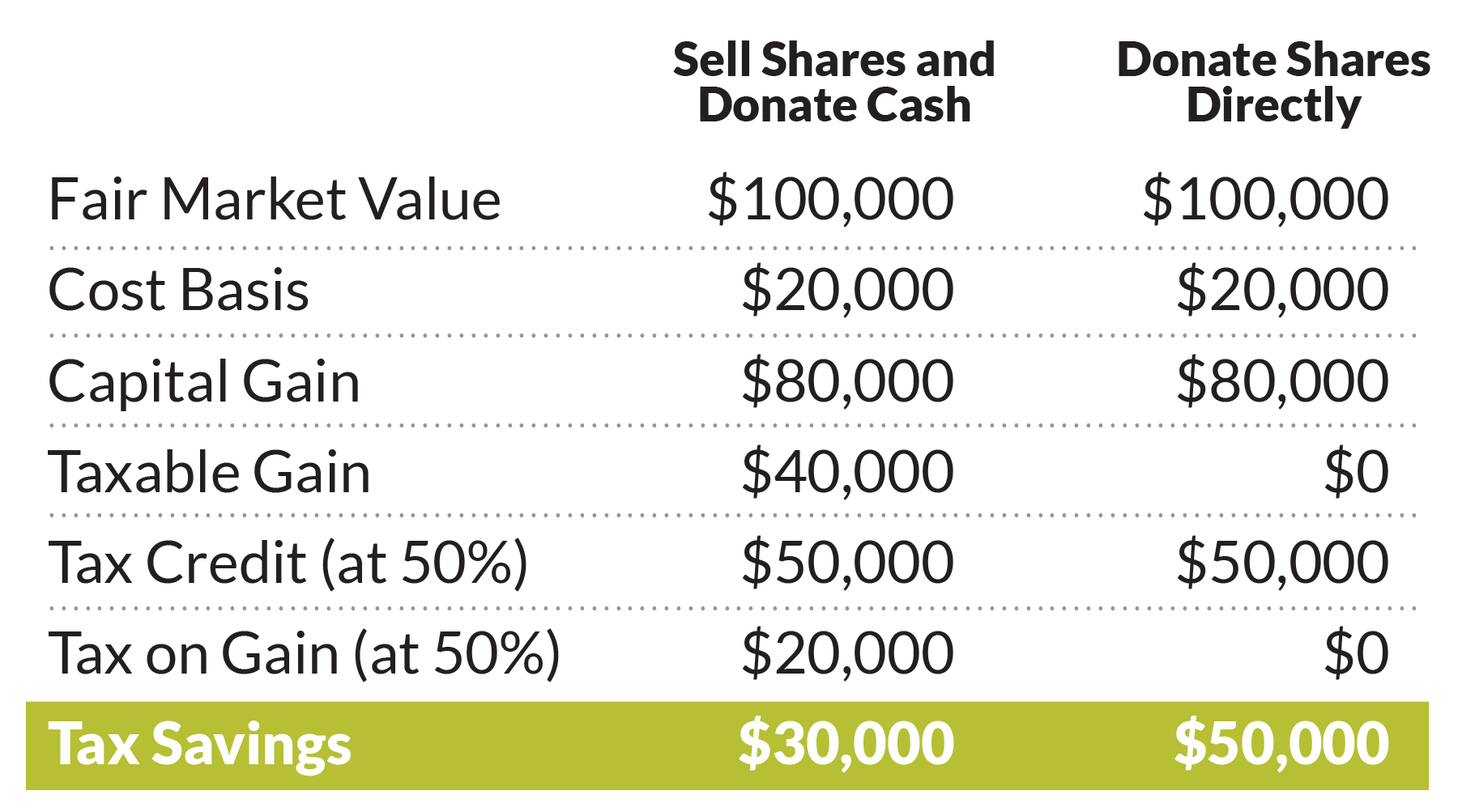

How much can you save by donating a gift of securities:

Ella and Tom decided to support Kerr Street Mission Foundation with a gift of $100,000. They learned that they would have a greater net tax benefit by donating their public securities directly to Kerr Street Mission Foundation rather than by selling them and donating the cash proceeds. This chart comparing the costs and savings assumes a tax rate of 50 per cent.

Life Insurance

- Reduce estate taxes

- Receive immediate tax benefit

A modest annual life insurance premium, paid over time, can result in a significant future legacy to a cause important to you.

Benefits of gifts of life insurance:

- Affordable annual premiums, which convert to a large gift

- Receive a charitable tax receipt

- Gifts of life insurance are not included in probate

Example of how a gift of life insurance works:

Priyanka takes out a new life insurance policy for $125,000, naming “Kerr Street Mission Foundation (CRA#: 724480405RR0001) as owner and beneficiary of the policy. Her annual premium of $1,050 has an approximate after-tax cost of $525 per year. The legacy amount is $125,000.

Three ways to donate life insurance:

- Donate an existing policy: receive a charitable tax receipt for the net cash surrender value and any premiums paid after the donation date.

- Donate a new policy: receive a charitable tax receipt for any premiums paid after the donation date.

- Assign Kerr Street Mission Foundation as the beneficiary of your individual or workplace insurance policy: your estate receives a charitable tax receipt.

Charitable Remainder Trusts

- Receive income for life

- Receive immediate tax benefit

A charitable remainder trust allows you to make a legacy gift now and receive an immediate charitable tax receipt, while enjoying the interest income for life.

Benefits of a charitable remainder trust:

- Receive lifetime income from the donated asset

- Receive a charitable tax receipt for the net present value of the assets in the trust

- Your gift can be kept private, as these types of gifts are not part of your will

- Charitable remainder trusts are not included in probate

- If all or the majority of your estate is intended for charity, a charitable remainder trust ensures you maximize your charitable tax receipts

How to establish a charitable remainder trust:

- Irrevocably transfer assets (a sum of money, securities, personal or real property) into a trust to be managed by a trustee, such as a financial institution, yourself, a lawyer or other individual.

- In the trust document, name yourself or others as the beneficiary of the interest income and name the Kerr Street Mission Foundation (CRA #: 724480405RR0001) as the remainder beneficiary.

Stocks and Securities

- Reduce estate taxes

- Receive immediate tax benefit

- Reduce capital gains tax

Donating public securities is a tax-smart way to support Kerr Street Mission. The value of your charitable tax receipt is based on the market closing price on the day that the Kerr Street Mission Foundation receives your gift in its brokerage account.

Benefits of gifts of stocks and securities:

- Receive a charitable tax receipt for the fair market value of the donated security

- Benefit from a capital gain inclusion rate of zero when you directly donate eligible securities

- When your executor donates eligible securities, your estate does not pay the capital gains tax that is triggered on death under the Graduated Rate Estate Rules, and it also benefits from the full charitable tax receipt

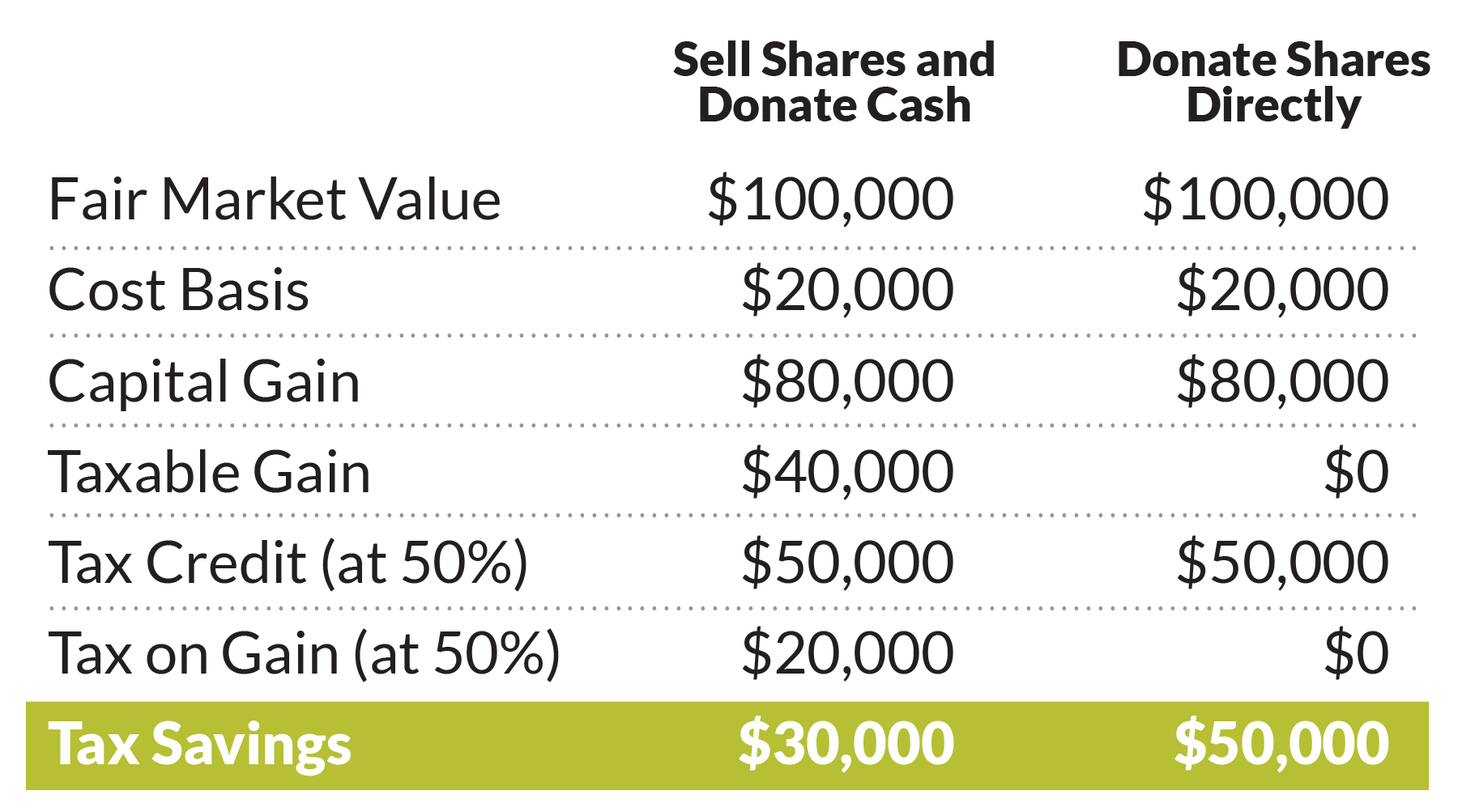

How much can you save by donating a gift of securities:

Ella and Tom decided to support Kerr Street Mission Foundation with a gift of $100,000. They learned that they would have a greater net tax benefit by donating their public securities directly to Kerr Street Mission Foundation rather than by selling them and donating the cash proceeds. This chart comparing the costs and savings assumes a tax rate of 50 per cent.

Bequests

- Reduce estate taxes

Wills are the central pillars of estate planning. You can make a gift by will, known as a bequest, for a specific dollar amount or item, or for a share or a percentage of your estate.

Benefits of making a bequest:

- You have the use of the asset during your lifetime

- A bequest reduces taxes owed by your estate

- A bequest is revocable and can be modified if your financial circumstances change

Registered Retirement Funds

- Reduce estate taxes

Kerr Street Mission Foundation can be named as a direct beneficiary of Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Funds (RRIFs).

Benefits of planned gifts of RRSPs and RRIFs:

- There is no cost to creating a registered retirement fund gift

- Your gift can be kept private, as these types of gifts are not part of your will

The balance of your retirement fund is not included in probate - Generate a charitable tax receipt to offset taxes that become due in the year of death, when the remaining funds in most RRSPs/ RRIFs become fully taxable as income

How to arrange a gift of RRSPs and RRIFs to Kerr Street Mission Foundation:

Fill out the beneficiary designation clause of your RRSPs and RRIFs, using the legal name “Kerr Street Mission Foundation.” Our Charitable number is 724480405RR0001.

How to make an immediate as well as a future impact:

If you find that you do not need the required annual withdrawal from your RRIF, you may consider donating this annual amount to Kerr Street Mission Foundation to offset your taxes.

Stocks and Securities

- Reduce estate taxes

- Receive immediate tax benefit

- Reduce capital gains tax

Donating public securities is a tax-smart way to support Kerr Street Mission. The value of your charitable tax receipt is based on the market closing price on the day that the Kerr Street Mission Foundation receives your gift in its brokerage account.

Benefits of gifts of stocks and securities:

- Receive a charitable tax receipt for the fair market value of the donated security

- Benefit from a capital gain inclusion rate of zero when you directly donate eligible securities

- When your executor donates eligible securities, your estate does not pay the capital gains tax that is triggered on death under the Graduated Rate Estate Rules, and it also benefits from the full charitable tax receipt

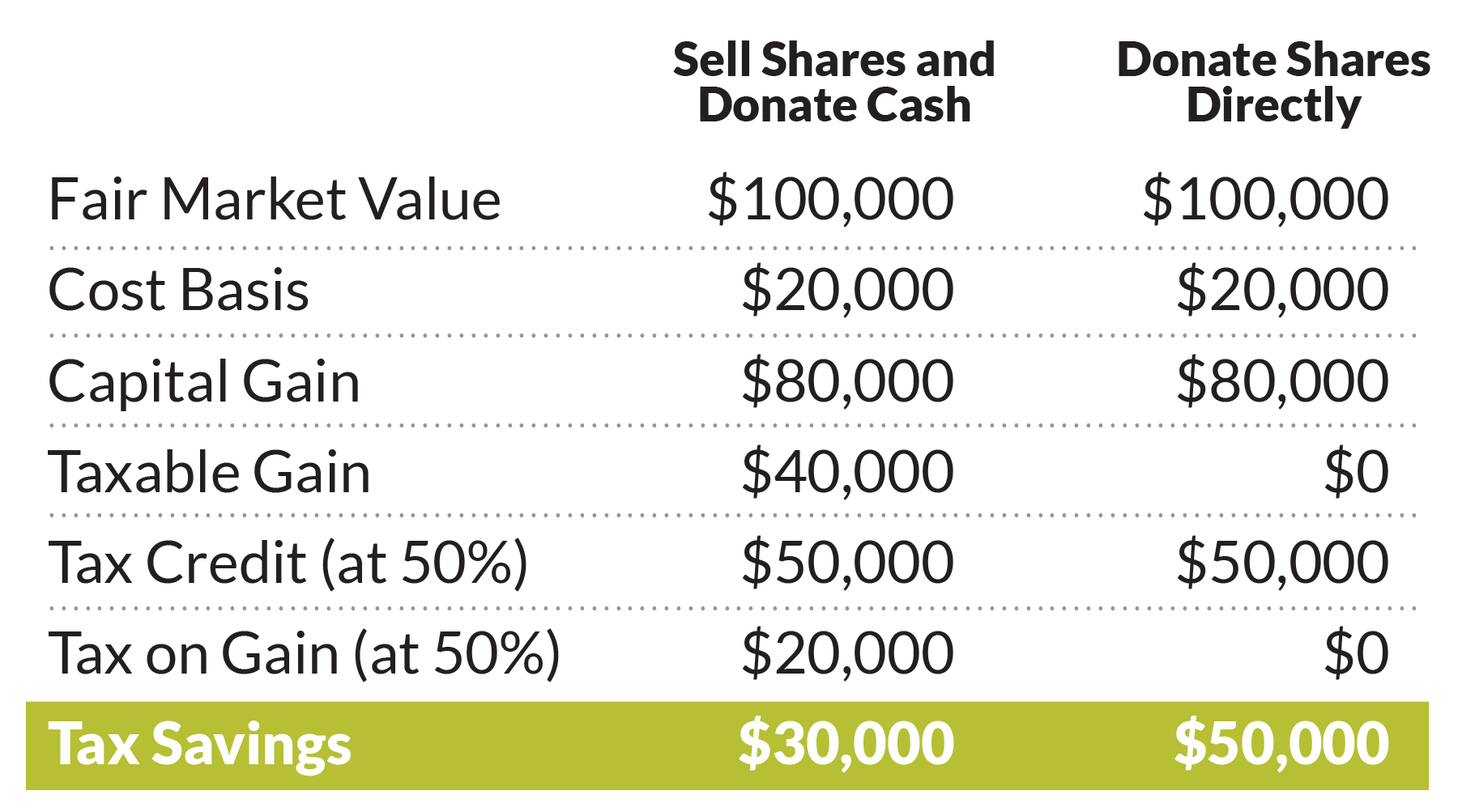

How much can you save by donating a gift of securities:

Ella and Tom decided to support Kerr Street Mission Foundation with a gift of $100,000. They learned that they would have a greater net tax benefit by donating their public securities directly to Kerr Street Mission Foundation rather than by selling them and donating the cash proceeds. This chart comparing the costs and savings assumes a tax rate of 50 per cent.

Life Insurance

- Reduce estate taxes

- Receive immediate tax benefit

A modest annual life insurance premium, paid over time, can result in a significant future legacy to a cause important to you.

Benefits of gifts of life insurance:

- Affordable annual premiums, which convert to a large gift

- Receive a charitable tax receipt

- Gifts of life insurance are not included in probate

Example of how a gift of life insurance works:

Priyanka takes out a new life insurance policy for $125,000, naming “Kerr Street Mission Foundation (CRA#: 724480405RR0001) as owner and beneficiary of the policy. Her annual premium of $1,050 has an approximate after-tax cost of $525 per year. The legacy amount is $125,000.

Three ways to donate life insurance:

- Donate an existing policy: receive a charitable tax receipt for the net cash surrender value and any premiums paid after the donation date.

- Donate a new policy: receive a charitable tax receipt for any premiums paid after the donation date.

- Assign Kerr Street Mission Foundation as the beneficiary of your individual or workplace insurance policy: your estate receives a charitable tax receipt.

While every effort has been made to ensure the accuracy of information provided, tax laws change over time and vary by jurisdiction. Donors are encouraged to consult with their professional advisors.